By David Peel

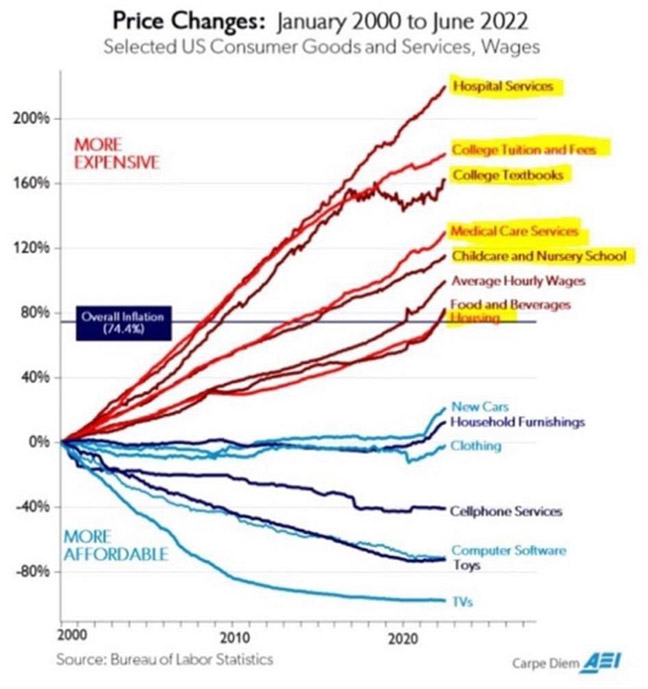

It is no news to anyone that the cost-of-living continues to rise. But it is interesting to see what has risen versus what has stayed the same or even gone down. And yes, some things have gone down.

Let’s cover that first. Consumer goods such as TVs, microwaves, and consumer electronics have continued to plunge in real dollars.

This was really driven home to me recently as I looked up the old Sauder brand desk that I still have in my office. I bought it on Getwell Avenue in 1994 for almost $200. And it looks nice but it’s really just pressed wood and veneer tape. That identical desk as far as I can tell is available right now for $298 dollars. Given the inflation that’s happened in these 30 years it’s probably actually cheaper now than it was then.

And I am amazed at the way they practically give away flatscreen TVs for less than the price of the phone I carry around in my pocket.

But when you look at things, like healthcare, higher education, and the cost of housing, it is hard to overstate how much that has grown.

Now there is one similarity among the things that have grown exponentially that is not true in the things that have stayed relatively stable or fallen. Can you guess it?

Government. The government has either created, or allowed a bubble in these industries. It’s often been said that if you show me the incentives, I can show you the behavior and the results.

The incentive for high education is free wheeling student loans for otherwise not credit worthy individuals with no relationship to what their degree might actually bring in in terms of income. So people are free to go borrow $120,000 to get a liberal arts degree with an emphasis in the English literature, and unless they teach, they are likely to wind up working at Starbucks. In the real world, no bank would loan those kind of funds for such a thing. They be doing well borrow one percent of that at the local bank or credit union.

And the saddest thing is that if that young student was entrepreneurial and went to the local bank to borrow money to start a business like a food truck, it would be very very difficult for them to get funded. They may be able to get a small business administration loan, which again is government funded.

As Dr. Adrian Rogers, often reminded us “the one thing that we learn from history is that we do not learn from history.”

And now there’s another trend that you may have noticed. Large investors are buying up small to medium service businesses, such as automotive shops, home improvement firms, HVAC and plumbing services, and mechanical contractors. Many of these business owners do not have children who are interested in taking over the business, so the owner does a sale and sometimes retains some interest in the business.

The investors get the reputation and long-standing local connections of a local business. Of course naturally they raise prices, and then the folks who built the business tend to eventually leave, but this is happening all over.

What trends are you noticing?

From David: Thank you for all the support of the local history videos we have been featuring on our Peel Law Firm Facebook page! In our continuing efforts to benefit local charities, I have designed local t-shirts and hats with all profits to charity— just in time for your gift giving. See the ever expanding store at PeelLawFirm.com!